Archive for the ‘Uncategorized’ Category

Blog Archives

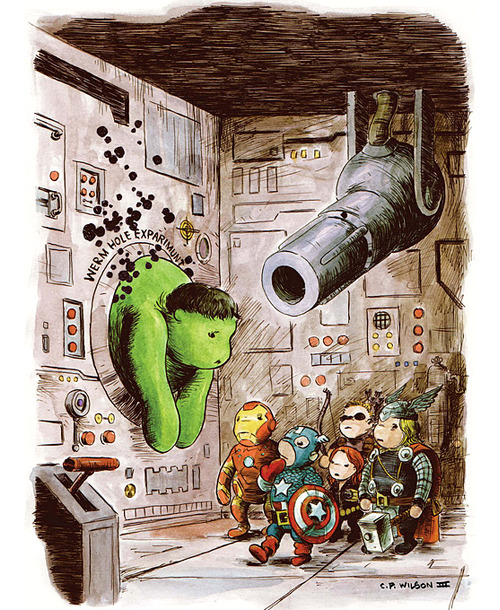

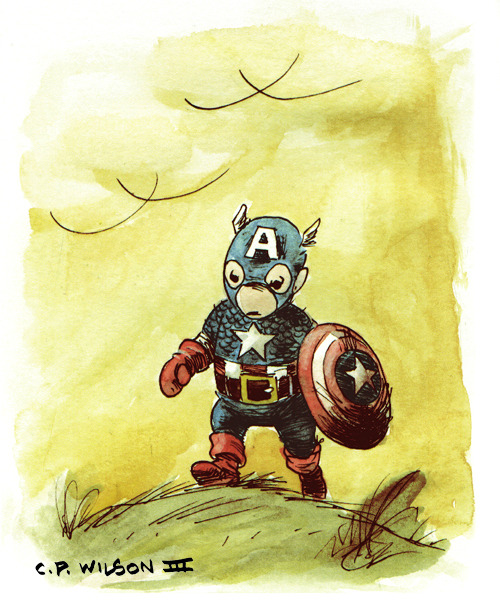

justinrampage: The Avengers clan gets a Winnie the Pooh…

Werm Hole Exparimunt

Wolverine Meets the Hulk

Apocalypse

Queen Industries’ Finest

Incredible Hulk Water Color Test

Captain America Water Color Test

The Avengers clan gets a Winnie the Pooh redesign in Charles Paul Wilson III’s excellent set of commission / cover artwork. See more of his work here.

Winnie The Pooh Avengers by C.P. Wilson III (deviantART) (Twitter)

Via: Super Punch

#

A visual map of human kind’s space exploration.

A visual map of human kind’s space exploration.

#

The Benefit and The Burden: American Tax Reform-Why We Need It and What It Will Take

author: Bruce Bartlett

name: Paul

average rating: 3.62

book published: 2012

rating: 3

read at: 2012/03/07

date added: 2012/03/07

shelves: non-fiction

review:

Some things I liked about Bruce Bartlett‘s book about tax reform are as follows:

1. The writing is clipped, precise and unadorned. For a book about, of all things, taxes, this is a welcome decision and it works to have the book broken down into concise chapters that stick to a topic, cover the material and then move on. Bartlett doesn’t waste time trying to over-explain everything, relying on the reading comprehension of the reader to draw the necessary conclusions.

2. Bartlett takes a refreshingly moderate stance on the political aspects inherent in conversations about taxation. Bartlett worked for the Regan and Bush I administrations, but his views aren’t Glen Beck riot conservatism, he just happens to be somewhat Republican-leaning. The faults he finds with the resistance to tax reform are widely spread and he’s not afraid to lay the blame wherever it is found. One gets the sense that if all contentious topics in politics could be discussed in this manner, there might be a chance for legitimate, effective, reasoned change in this country.

3. The book is extensively researched, exhaustively referenced, and full of supporting evidence for the opinions and presented facts.

Now, some things I didn’t care for about The Benefit And The Burden:

1. The no-nonsense prose on display here is almost so bare as to be challenging to muddle through. The salvation is the brevity of each point, but my own ignorance of economics and tax principles really made this a trying book at times. This isn’t really a fault with Bartlett in and of itself, but for anyone hoping to have a gentle introduction into modern tax theory and economic principles, start somewhere else because Bartlett doesn’t have time to carry you along.

The way that this manifests as a negative in the book is that it’s sometimes hard to decipher who the target audience for the book is. I presume economists are perfectly aware of all this information and a piece directed at them could have been shorthanded all the way into an essay. Know-nothing laypeople like myself may find the book to be a bit insider-y, presuming basic familiarity with a lot of the core concepts which can make a lot of the book seem foreign and unfathomable. The best I can figure is that this book is for highly educated people with a decent background in economics, to whom this may be simply an extended persuasive op-ed, but considering the inflammatory state of national politics at the moment, it’s hard to think that the narrow band of moderate academics make up a sufficient demographic for a viable book sales projection.

2. The brief chapters and extensive “Additional Reading” sections make the book feel a bit like an annotated bibliography rather than a complete work in itself. It’s sort of cheap to praise a book for being well-referenced and also to complain that the book relies on these references for support, I know, but I did feel that there was the potential for a middle ground where some additional detail was included (perhaps more quoted source material?) to make the book feel more stand-alone without artificially inflating the presentation.

Overall, I felt that Bartlett was very persuasive. The Benefit And The Burden is essentially an argument for Value Added Taxes (VATs) which are essentially labor taxes that are paid and credited through the production chain until the burden falls on the consumer (like a layered sales tax at the federal level). Bartlett lays out how current taxes work, explains why tax increases are going to be necessary in the near future and then describes why VATs are the best option for managing the necessary tax hikes to avoid deficit fallouts like inflation and weakened US economies. Bartlett is also pretty fair to detractors of VATs as he devotes plenty of time to defining alternate methods and highlighting some of the serious (or not so serious) arguments against VATs.

I wouldn’t say I necessarily recommend the book to just anyone, but for people who want a decent overview of the current economic state and the potential issues that could result from it, and then want a well-thought-out proposed solution to those problems, this is a good place to start.

Physics / Water / Art

On The Shelf.

On The Shelf.

On The Table.

On The Table.

#

Invisible Children Follow-Up

This is a companion to the video I reblogged last night for Invisible Children and it’s Stop Kony 2012 campaign. I didn’t have time to do much research last night but this morning I took a look at some of the details of the situation in Uganda, IC and the campaign itself. Now, I still think it’s a noble cause and I think some people make a lot more out of administrative costs for non-profit organizations than are truly necessary (the whole “only x cents of every dollar you donate actually does y” thing). I’m not sure that people establishing charities should necessarily require charity themselves just to do their work. In other words, in some cases, haters gonna hate.

However, there are some genuine concerns about the simplification that IC’s video employs to get its point across, and there is a much deeper level of political and foreign policy consideration that is overlooked in favor of “let’s just stop the bad guy.” In particular the criticism that the voices of the oppressed (the Ugandan people) are largely ignored in favor of an obvious (but not, I don’t think, inherently immoral) play on class/status guilt is concrete enough. IC comes across as pretty paternalistic, too.

That being said, if IC wants to focus on awareness raising rather than action, I think ultimately that’s not a bad thing as it also opens doors for other groups and organizations working toward the same or fundamentally similar goals. I think the biggest concern for people deciding on whether to directly support IC or some other specific organization should be based on whether the favored approach is militaristic or not.

But what I don’t think the controversy around IC should do is stop anyone from helping at all, if they possibly can.

#